Effective Federal Tax Rate 2025. Our free tax calculator will help you estimate how much you might expect to either owe in federal taxes or receive as a tax refund when filing your 2025 tax return in 2025. This is because marginal tax rates only apply to income that falls within that specific bracket.

Your income is broken down by thresholds. Based on these rates, this hypothetical $50,000 earner owes $6,307.50, which is an effective tax rate of about.

The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2025 tax year (the taxes you file in april 2025) and the 2025 tax.

Tax rates for the 2025 year of assessment Just One Lap, As you surpass each threshold, your income gradually moves to a higher bracket with a higher tax rate. Federal income tax rates and brackets.

How To Calculate Tax On Salary Wholesale Deals, Save 40 jlcatj.gob.mx, As you can see from the federal income tax brackets, your marginal tax rate would be 12%. Your income is broken down by thresholds.

Tax brackets 2019 vptiklo, To achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2025. Bloomberg tax has released its annual projected u.s.

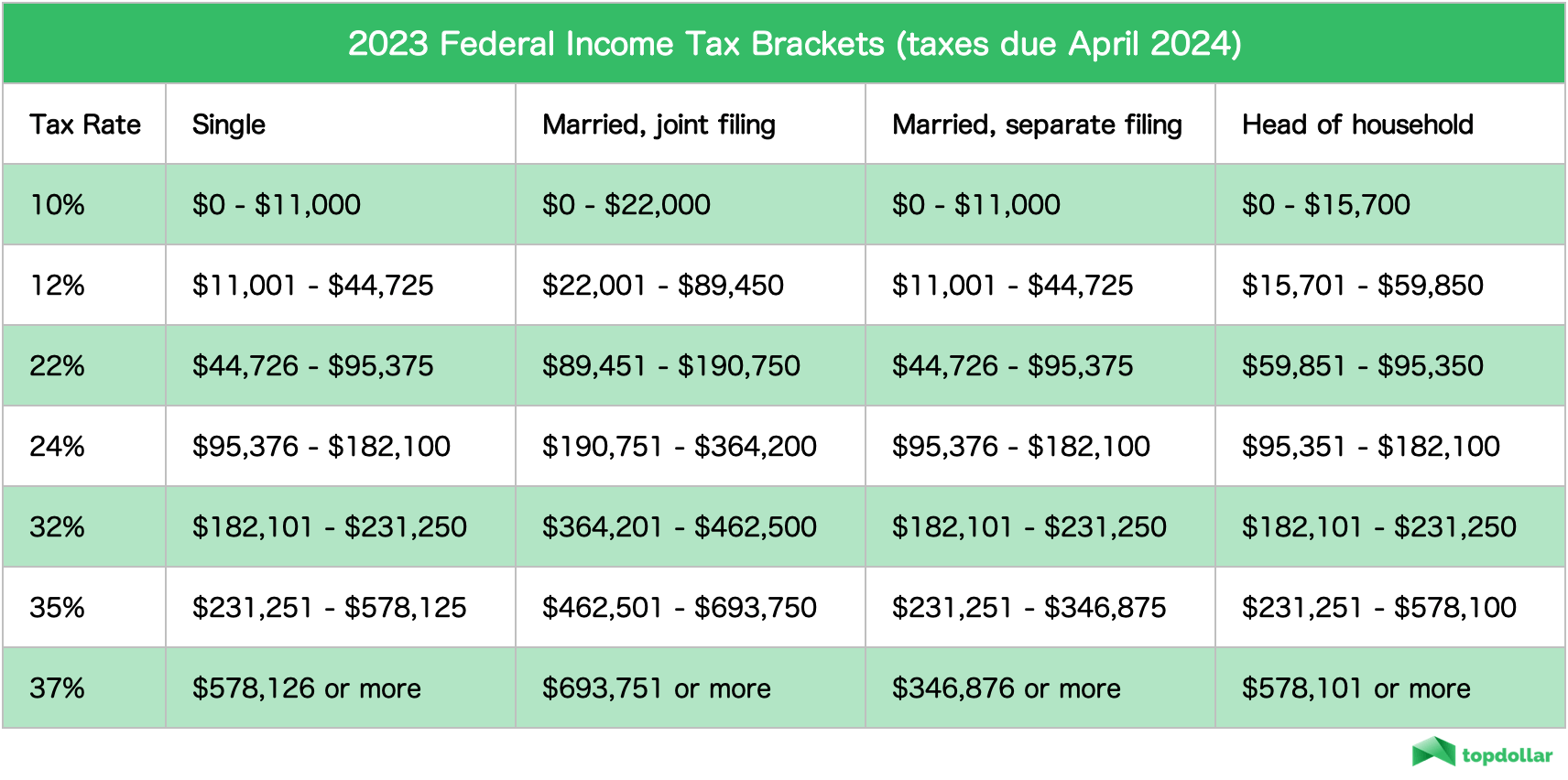

2025 Tax Rates & Federal Tax Brackets Top Dollar, The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2025 tax year (the taxes you file in april 2025) and the 2025 tax. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

tax rates 2025 vs 2025 Kami Cartwright, You pay tax as a percentage of your income in layers called tax brackets. As your income goes up, the tax rate on the next.

2025 Irs Tax Table Chart, As you surpass each threshold, your income gradually moves to a higher bracket with a higher tax rate. For example, for the 2025 tax year, the 22% tax bracket.

Ranking Of State Tax Rates INCOBEMAN, Tax bracket ranges also differ depending on your filing status. You pay tax as a percentage of your income in layers called tax brackets.

U.S. Effective Corporate Tax Rate Is Right in Line With Its OECD Peers, So while your marginal tax rate is 24%, you’re paying only 18.5%. Chargeable income in excess of $500,000 up to $1.

How Federal Tax Rates Work Full Report Tax Policy Center, Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2025, including. This is because marginal tax rates only apply to income that falls within that specific bracket.

25 Percent Corporate Tax Rate? Details & Analysis, 10%, 12%, 22%, 24%, 32%, 35% and 37%. Divide that by your earnings of $70,000 and you get an effective tax rate of roughly 15 percent, which is lower than the 22 percent bracket you’re in.

Based on these rates, this hypothetical $50,000 earner owes $6,307.50, which is an effective tax rate of about.